Australian Dollar Option Flows Bias

Option flow analysis involves tracking direction of options trades being executed in the market. This information frequently yields valuable insights into potential price movements and insider trading activities

Frequently Ask Questions

Option flows is a highly useful tool for assessing market conditions, but it must be interpreted accurately, which is often not the case. It requires significant practice and a deep understanding of the logic behind option portfolios to extract meaningful sentiment and distinguish it from the typical noise associated with options. insider sentiment, which has a predictive value regarding the future movement of the market, is obtained exactly using data from the options market.

The Chicago Mercantile Exchange (CME), colloquially known as the Chicago Merc, is an organized exchange for the trading of futures and options. The CME is the largest futures and options exchange by daily volume. According to CME Group, the exchange handles 3 billion contracts per year, worth approximately $1 quadrillion

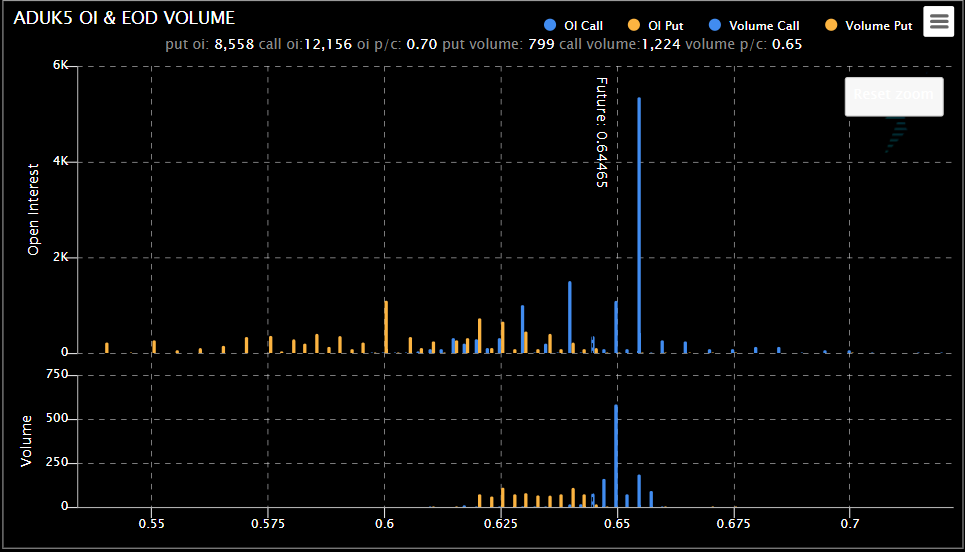

The chart illustrates the variation in open interest (active trades) across different strike prices over the past day. As multiple option series with varying expiration dates are traded simultaneously on the CME exchange, we only display the nearest monthly series for the instrument. Additionally, we transition to a new monthly series five days prior to the expiration of the current one, as all trading activity shifts to the upcoming option series. According to our observations, it is in the monthly and quarterly option series that the activity of both large participants (Smart Money) and insiders is most evident.